ČSOB, part of KBC Group and the fifth-largest insurer in the Czech Republic, had a fraud detection process, tools, and dedicated employees. Despite this fact, the insurer felt a need to innovate and increase fraud detection efficiency, decrease false positives and protect themselves from evolving fraud activity.

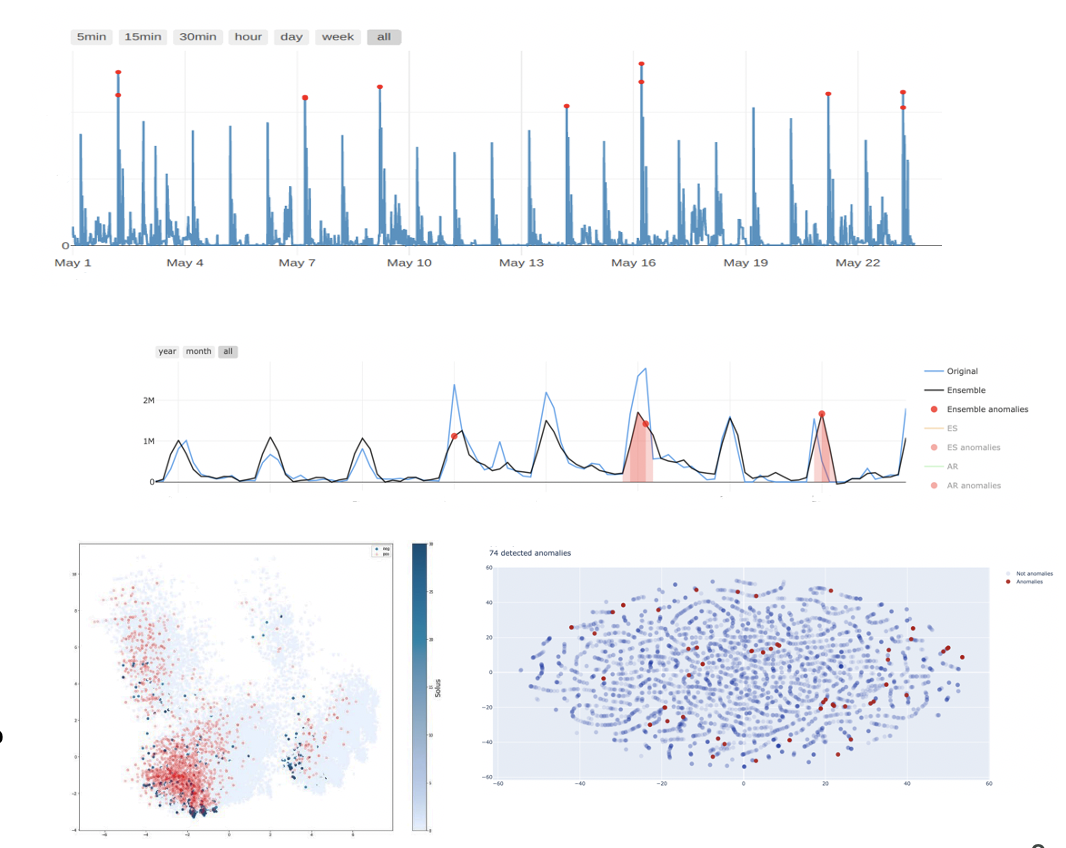

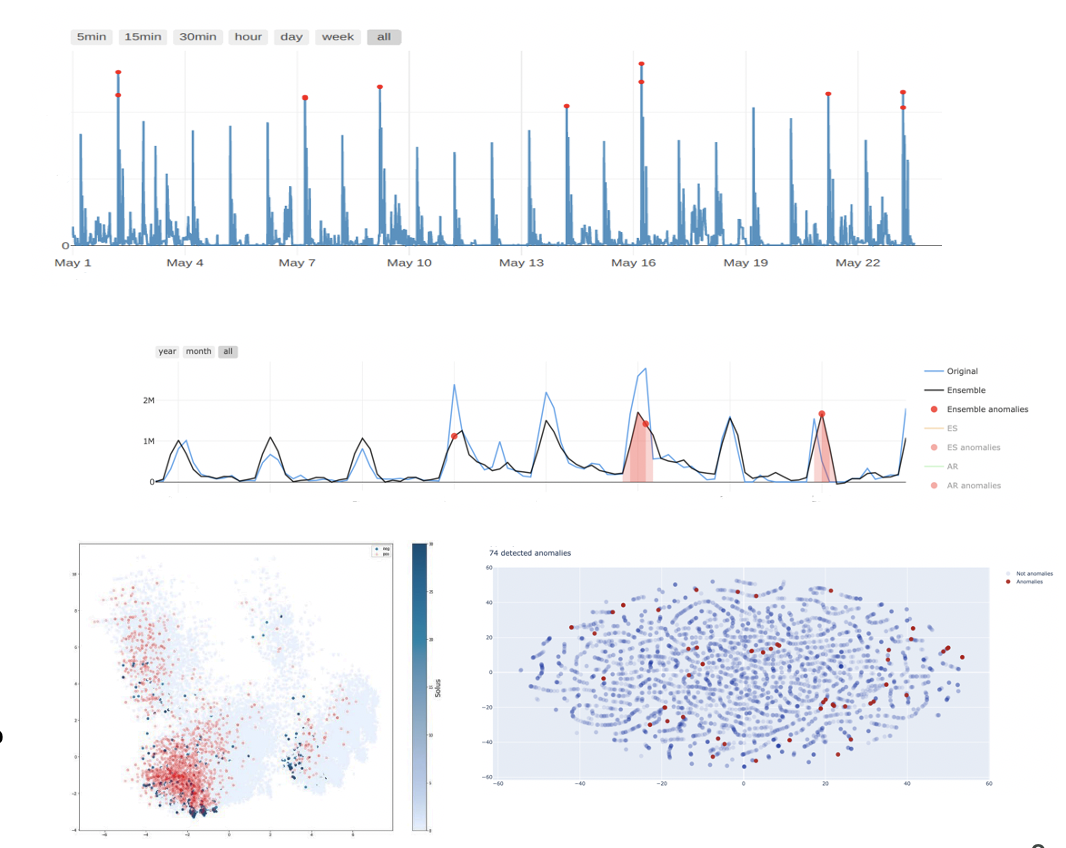

We leveraged historical claim data by applying our fraud detection framework ADF. ADF processes a comprehensive set of time series and data clusters. Thanks to a wide range of algorithms that leverage statistical and machine learning methods, it can report significant outliers or clusters. The user can give feedback to the system and thus regulate the number of anomalies received for analysis and teach the system what an anomaly is and what is not.

As a result, AI models picked up complex patterns from claims, policy and other data enabling reliable fraud detection and whitelisting at the same time.

When applied to the historical claims data, ADF automated the fraud-detection process, allowing analysts to concentrate on relevant cases, reducing false positives by 60%, increasing operational efficiency, and improving the customer experience.